Healthcare has been traditionally viewed as beyond consumer trends, more focused on patient health and new treatments than on consumer strategies. But today Americans of every generation are proving themselves to be savvy consumers increasingly accustomed to technology, convenience, information access, and affordability.

Their expectations of healthcare delivery and treatment are no different, which means patients of all ages are now driving the decisions that providers must make about their services and costs.

In addition, the COVID-19 pandemic is accelerating the healthcare consumerism trend as safety and prevention take on greater importance with patients and providers alike. Consumers are more engaged in their healthcare as a result of the pandemic, and are paying attention to the cost, safety, and level of care they receive. The most responsive providers will win the competitive edge in this changing landscape.

In this article, we’ll discuss four trends driving healthcare consumerism: 1) changing patient demographics and demands, 2) the new competitor landscape, 3) technological advancements, and 4) patient information access, which substantiate the need for healthcare providers to optimize their ambulatory networks, to rely less on hospital-based care and more on highly visible and accessible community-based outpatient centers.

We’ll also highlight the most prominent retail tactics being used to eliminate friction points in the patient experience as well as examples of healthcare providers at the forefront of adoption—both during the pandemic and beyond.

4 Powerful Trends Driving Healthcare Consumerism

1. Changing Patient Demographics and Demands

In the US, approximately 200 million people were born between 1946 and 1998–these Baby Boomers, Generation X, and Millennial populations are now setting nearly identical expectations for healthcare providers as they do for retailers. According to US Census Bureau data, by 2030 older people will outnumber children for the first time in US history, with one in five Americans reaching retirement age that year. By 2035, approximately 78 million Americans will be over 65, versus 76.7 million who will be 18 or under.

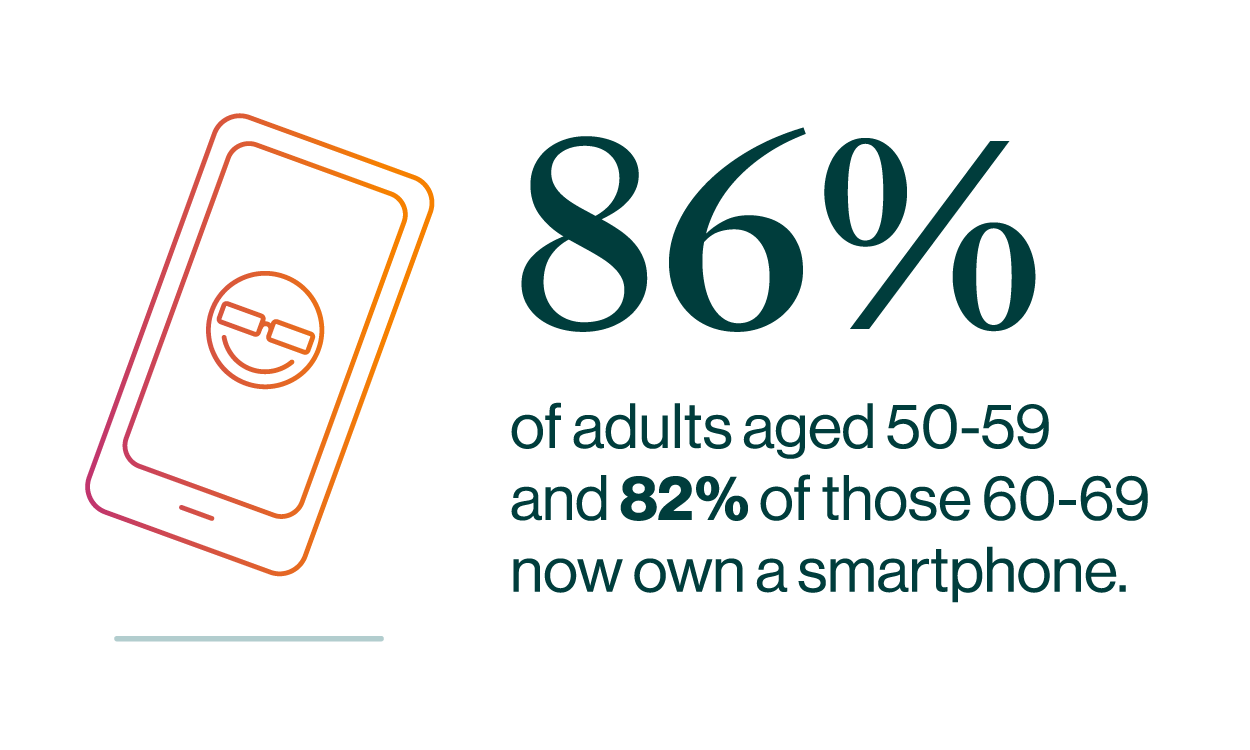

The aging population is not only poised to swell, but Baby Boomers are bringing tech chops and consumerism-era demands that health systems will be smart to embrace. According to AARP, 86% of adults aged 50-59 and 82% of those 60-69 now own a smartphone. More than half of those surveyed said they’d prefer their medical needs to be managed by a combination of healthcare professionals and technology.

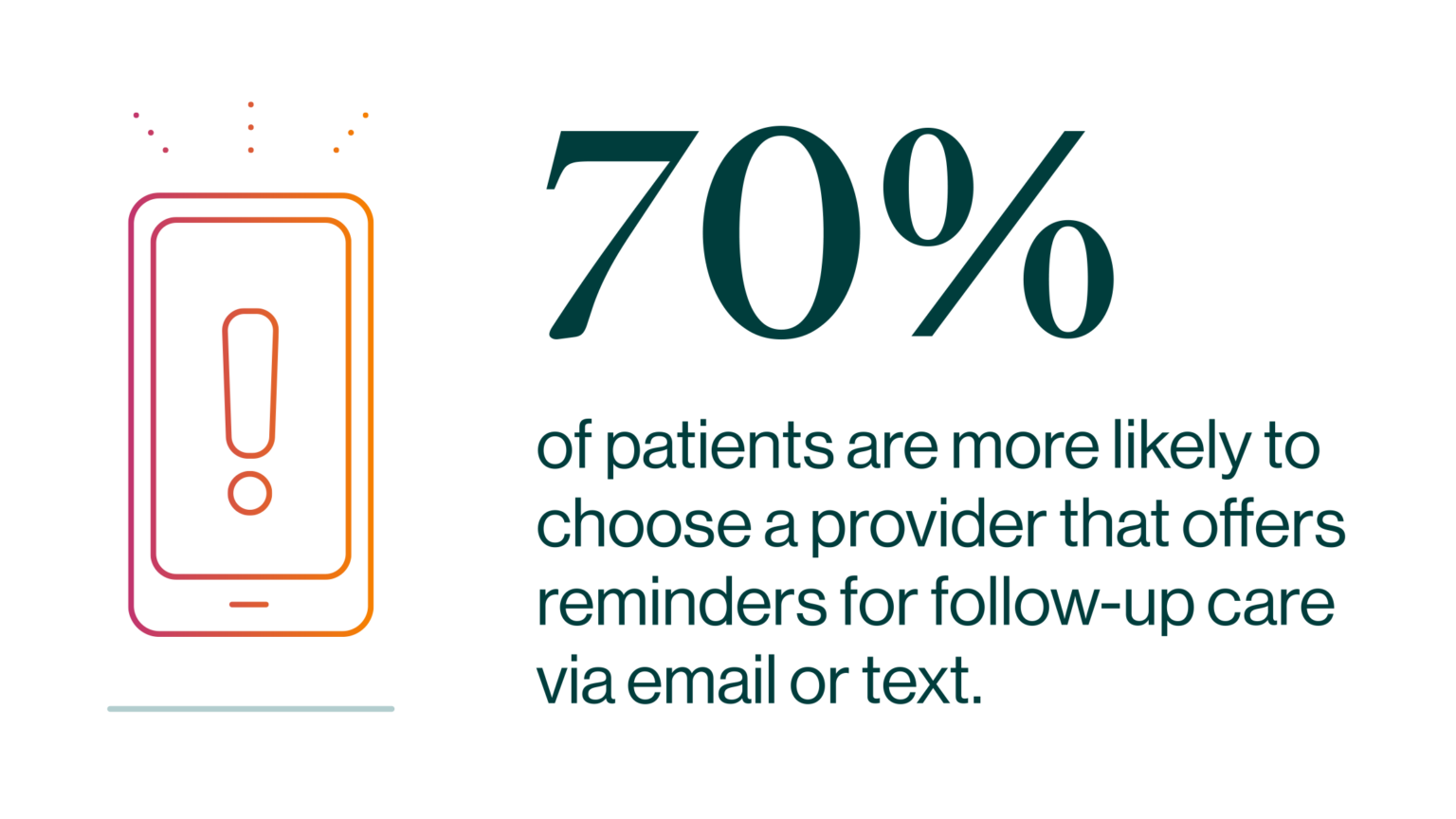

Digital capabilities—from booking appointments to requesting prescription refills—are now expected, and increasingly influence who patients choose as their provider. For instance, in a 2019 survey by Accenture, 70% of patients are more likely to choose a provider that offers reminders for follow-up care via email or text, compared to 57% in 2016. Also, in 2019, more than half (53%) of patients are more likely to use a provider offering remote or telemonitoring devices, compared to 39% in 2016.

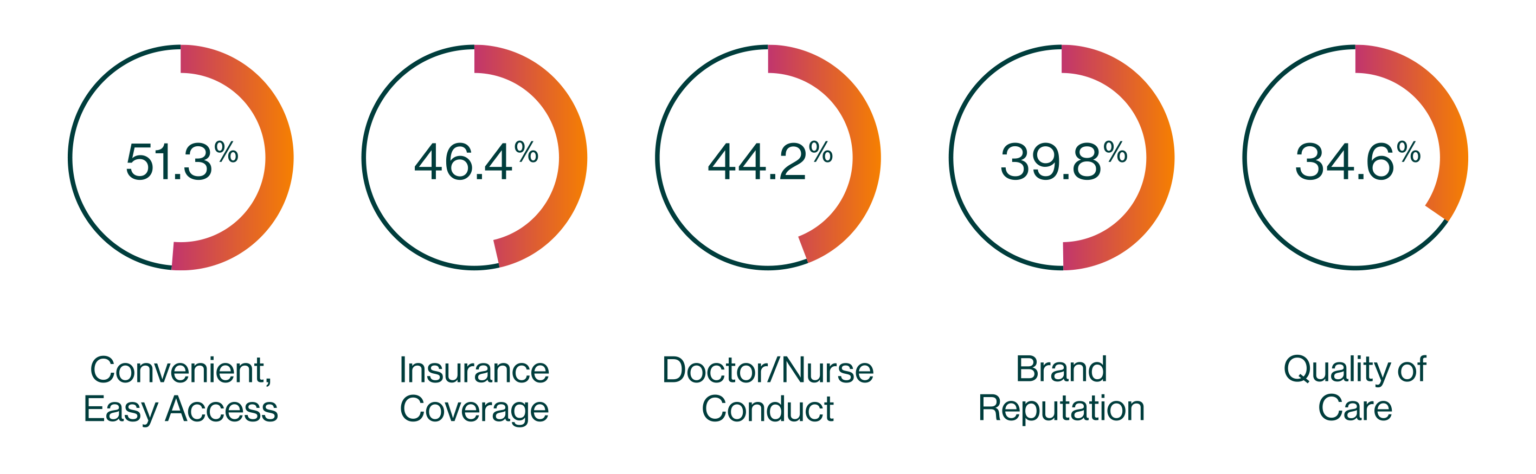

For the majority of consumers, convenient and easy access to care is the most important factor in selecting a provider.

And although primary care referrals still drive the majority of specialty visits, self-referrers now comprise up to 47% of patients in some specialties.

2. New Competitor Landscape

Whereas health systems and physician groups once primarily competed against each other, traditional healthcare providers now face a whole new landscape of competitors.

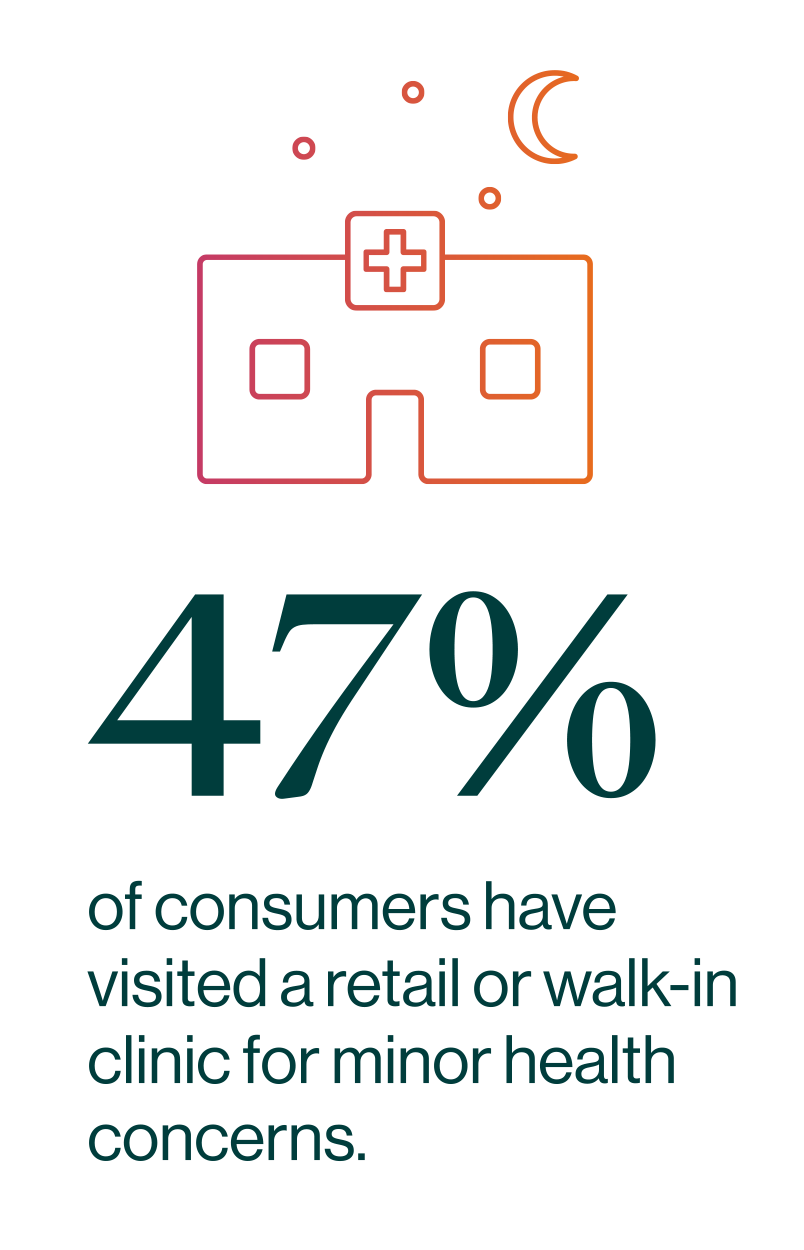

The growth of competition from big box retailers, pharmacy chains, and even grocery stores offering convenient, low-cost walk-in services for common and/or non-life-threatening illnesses is expected to continue to put pressure on traditional healthcare providers. According to Accenture, nearly half (47%) of consumers have visited a retail or walk-in clinic for minor health concerns. Retail clinics currently fill nearly 75% of market demand for vaccinations and point-of-care diagnostics, and the retail clinic market is predicted to surpass $8 billion by 2028, potentially growing at an annual rate of 21%.

Private equity and venture capital firms are consolidating specialty practices such as dermatology, orthopedics, ophthalmology, and other specialties, and also backing retail urgent care startups. Private equity ownership of physician practices more than doubled between 2012 and 2017, and the trend shows no sign of stopping. Insurance companies are also joining in, inking relationships with existing health systems and physician groups—and even creating healthcare providers of their own—in order to control costs and manage care more closely.

Reduced consumer reliance on primary care for referrals creates opportunities for VC firms and other competitors to capture patients through new entry points, such as urgent care clinics, orthopedic injury clinics, athletic trainer consults—even virtually.

3. Technological Advancements

Artificial intelligence (AI) is beginning to impact clinical care by assisting with initial diagnosis, reducing administrative overhead and improving workflow, and performing repetitive tasks. AI also may allow clinicians and staff to do their jobs more quickly and efficiently using text-to-talk to produce chart notes, ordering tests, and transmitting prescriptions. These innovations lead to a work time savings of 17% for doctors and 51% for registered nurses, allowing more opportunity for quality patient care. It’s estimated that AI could address 20% of unmet clinical demand, allowing outpatient care to grow.

The use of remote patient monitoring continues to rise. Remote patient monitoring is now covered by Medicare and 23 state Medicaid programs, and 13 states require commercial health plans to cover monitoring services.

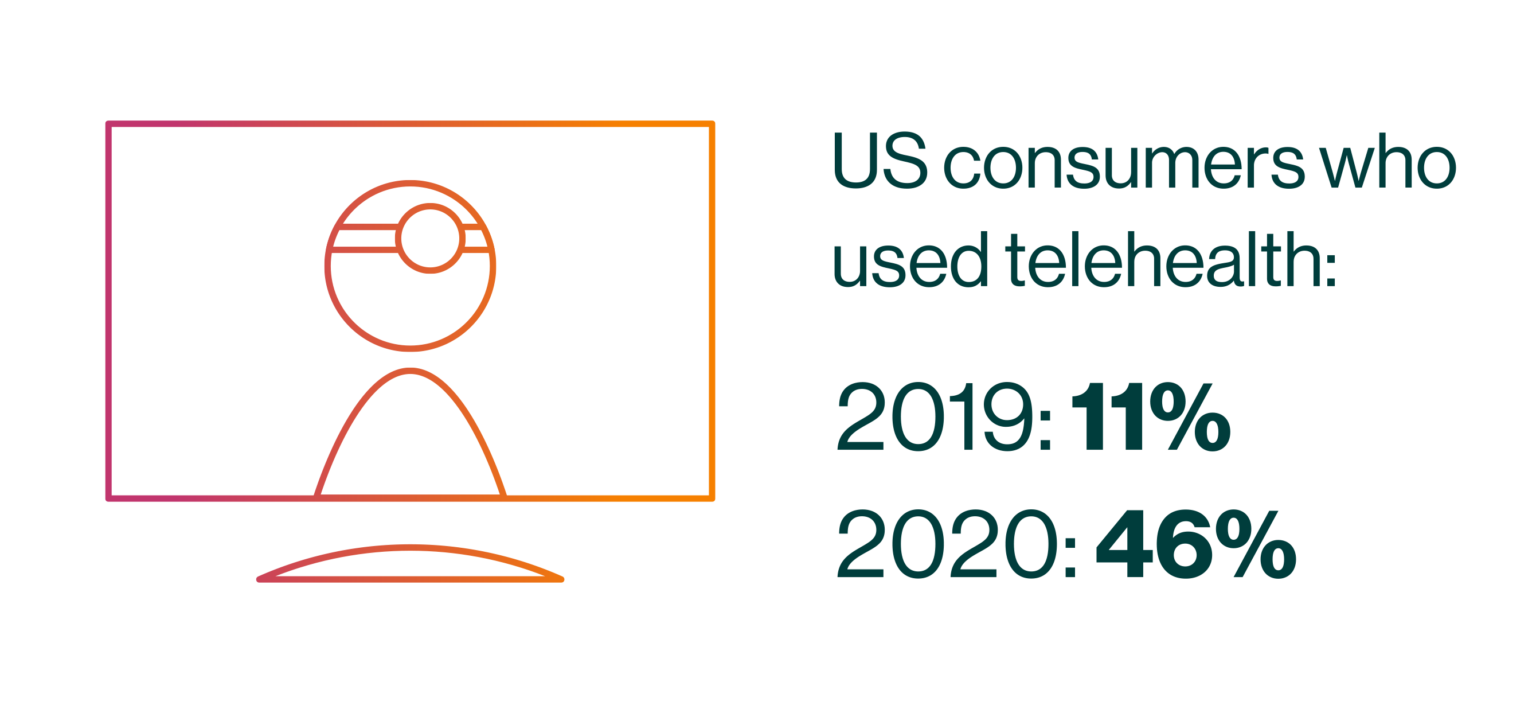

The COVID-19 pandemic has seen the rapid growth of telehealth service offerings. Health providers report conducting 50 to 175 times the telehealth visits pre-COVID. However, telehealth is more likely to supplement onsite care rather than replace it. Virtual consultations frequently result in in-person follow-up appointments and specialist referrals. Meanwhile, health systems will need to devote more space within hospitals and MOBs for telehealth provider suites, as well as the data lines and server rooms to support them.

4. Patient Information Access

Patients are no longer passive participants in their health care: they are demanding transparency, convenience, access, and more personalized products and services that they know technology can deliver.

The demand for online information and digital communication with health providers demonstrates that consumers are taking a greater interest in and technology-supported approach to their health services.

- More than 96% of hospitals now use Electronic Health Records (EHR) systems

- 62 percent of US adults ages 35-54 use online health information to make decisions about their treatment

But consumers are frustrated with their ability to find and access general and personal health information. According to a recent study, only 38.5% of US adults are able to access health information online without frustration. Making matters worse, studies find that fewer than 20% of patients on average have logged on and used their healthcare provider’s health portal.

Transparency about cost is equally important to both older and younger consumers—65% believe it to be critical or very important, according to Accenture. However, while older consumers place greater importance on transparency about care, younger patients are more concerned about convenience of appointment times and wait time and speed of appointment.

Retail Health Tactics and Innovations

Now let’s take a look at some of the most prominent retail tactics and innovations being used to eliminate points of friction in the patient experience as well as some of the traditional and non-traditional healthcare providers at the forefront of adoption.

1. Pre-Visit Experience

- AI pre-screening

- Online/on-demand scheduling

- Off-peak and weekend patient scheduling windows

- Digital appointment reminders

- Online registration/intake forms

- Transportation services

Partners HealthCare, AI-based COVID-19 Screener. As the pandemic grew in the US, Partners HealthCare in Boston began researching AI-based self-triage tools for patients, including interactive voice response systems for phone calls and online chatbots. Partners now offers a COVID-19 screener, an automated online tool that assesses patients via a simple chat interface that asks them a series of questions based on diagnostic information from the CDC and Partners experts. A similar system developed by Seattle’s Providence St. Joseph Health system and Microsoft served more than 40,000 patients in its first week of operation. Alibaba and other companies are developing AI algorithms to aid in epidemiology, analytics, and genome sequencing of the coronavirus.

Swedish Covenant Health, Boutique Clinic with On-Demand Scheduling. The Clark is a boutique primary care and women’s health clinic owned by Swedish Covenant Health on Chicago’s north side. Designed to provide an upscale, spa-like experience, The Clark offers same-day appointments by phone or online, and a concierge check-in process. In addition, it offers evening and Saturday appointments in order to accommodate the busy schedules of its city-dwelling patients.

MedStar Health/Uber Health, Patient Transportation Service. MedStar Health struggled with high no-show and cancellation rates for patient appointments, most occurring within one hour of their appointment. Access to transportation was one of the primary causes. MedStar turned to Uber Health, a service that uses Uber’s existing driver network to transport patients to appointments. Since offering Uber Health to patients, MedStar has increased schedule fill rates in three of its practices by 5% to 10%, creating a significant increase in revenue.

2. Point-of-Care Experience

- Convenient physical locations, telehealth options, and at-home care options

- Geofencing & efficient patient check-in and check-out

- Concierge services/personalized care coordination

- Free WiFi & patient education zones

- Engaging, comfortable waiting rooms and exam rooms

- Care team e-communication

Providence/Walgreens, ExpressCare Clinics. In the face of the retail walk-in clinic trend, Providence St. Joseph Health is fighting fire with fire. The health system launched Providence ExpressCare, a rapidly growing network of walk-in clinics in Washington, Oregon, and California. Designed to bridge the gap between a primary care visit and the emergency room, ExpressCare clinics provide diagnosis and treatment for common illnesses, treat minor injuries, and offer basic testing and screening. Many of the locations are located in Providence buildings, but the company has also partnered with Walgreens to operate retail health clinics at dozens of stores—and also offers virtual consultations.

MultiCare Children’s Hospital, Geofencing and Auto Check-In. Breaking ground in 2021, the new MultiCare Children’s Hospital in Tacoma, WA, will include eight to ten operating rooms, a mental health crisis center, and a cancer center—as well as an innovative geofenced patient check-in system. Families arriving in the hospital’s garage will get a parking stall assignment via a smartphone app. Once the vehicle is in the stall, the patient is automatically checked in and medical staff is notified of their arrival. The new system will reduce the need for large waiting rooms in the post-COVID era.

Think Whole Person Healthcare, Concierge Care Coordinators. Think Whole Person Healthcare facilitates a collaborative approach to patient care by borrowing several design cues from retail innovators such as Apple and Target in its Omaha, NE, health center. The building includes features such as an in-house pharmacy, café, and a gift shop in a modern, mall-like environment. In the system’s integrative care model, concierge care coordinators provide patients with one-on-one service that goes beyond traditional office visits. Care coordinators educate patients about their personal conditions, develop personalized care plans and coordinate doctor visits and preventative health screenings, find community resources to maintain health, and assist with referrals when necessary. Think’s high level of customer care has resulted in a 98.94% overall quality ranking, the highest in Nebraska and 8th highest nationally.

Halifax Health, Care Team e-Communication. Since 2009, Halifax Health, the largest medical provider in east-central Florida, physicians and staff have worn a wearable, wireless, hands-free, voice-controlled device that enables instant two-way or one-to-many conversations. Prior to implementation, EDs were cacophonous with overhead pages, and consulting a physician in another location required calling a central operator. Halifax Health has since implemented HIPAA-compliance-enabling secure texting between clinicians and physicians, which improved patient safety and cut down on response time dramatically—what used to take 30–45 minutes now takes seconds. As a result, the oncology unit reported an 8 percent decrease in the time it takes to discharge a patient, equivalent to 80 patients in a four-month time span.

3. Post-Visit Experience

- Digital follow-up reminders & telemedicine follow-up visits

- Remote monitoring tools/mHealth (Mobile Health) devices

- Centralized testing and vitals with timely reporting

- Drone delivery of medical samples and medications

- Patient-facing, secure, all-in-one healthcare record apps

- Pharmacy apps and medication reminders

Mayo Clinic, Remote Monitoring of Patients with COVID-19 and Chronic Illnesses. In many countries where novel coronavirus cases increased rapidly, hospitals became an inadvertent hot spot for disease transmission. US health systems have sought to avoid the same fate by minimizing unnecessary hospital visits and finding ways to care for and monitor patients at home. For instance, Mayo Clinic has canceled elective surgeries and is using telehealth to handle outpatient visits where possible. It’s also working with device manufacturers such as AliveCore and Eko to enable remote monitoring of patients with COVID-19 who don’t require intensive care, as well as patients with chronic conditions. The companies’ ECG and stethoscope products transmit data to an app accessible by physicians and integrate with telehealth services.

WakeMed Health, Drone Delivery of Medical Samples. In Raleigh, NC, WakeMed is partnering with UPS Flight Forward on a pilot program to use a drone to deliver medical samples from the hospital to a nearby lab for testing. UPS’s Matternet M2 quadcopter drones fly at speeds up to 43 mph, reducing a trip that takes up to 45 minutes on foot to less than 5 minutes by air. The drone is expected to make runs six to eight times a day, delivering more than 200 samples daily and cutting hours off of turnaround times for tests.

CVS Health, Drone Delivery of Medications. CVS Health has also partnered with UPS Flight Forward to test prescription delivery via drone. A pilot is being conducted in The Villages, FL, to quickly deliver time-sensitive medicine, while also maintaining social distancing. The first flights will be less than half a mile, and prescriptions will be dropped off to a nearby location for a ground vehicle to make the final delivery.

We Can Help

Remedy and Percival Health Advisors, its in-house strategic innovation and advisory firm, can help you understand how these trends may be affecting your business and identify tools and tactics that will enable you to respond. Get in touch to learn more.